Executive Summary

The EU entered the year on a weak footing…

After the historic drop in activity recorded in the first part of 2020 and the rebound in the summer, the EU economy faced another setback in late 2020 as the resurgence of the pandemic prompted a new round of containment measures. With output falling again in the last quarter of 2020 and the first of 2021, by a cumulative 0.9%, the EU was pushed back into recession. However, considering the stringency of the restrictions, the decline in activity was far milder than the downturn in the first half of 2020. Better adaptation of firms and households to the constraints of the pandemic environment, stronger support from global growth and trade, and continued strong policy support helped economic agents cope with the economic challenges.

…and the pandemic is still setting the course for 2021-2022…

Economic developments in 2021 and 2022 will be largely determined by how successfully vaccination programmes will tame the pandemic and how quickly governments will lift restrictions. For the EU, the forecast assumes that following a marginal easing of restrictions in the course of the second quarter, progress in vaccinations will enable a more marked easing of restrictions in the second half of the year. In 2022, COVID-19 will remain a public health concern, despite the high share of the population being vaccinated (including refreshed protection when needed, for example due to new variants). It is therefore assumed that some limited containment measures will be in place as needed.

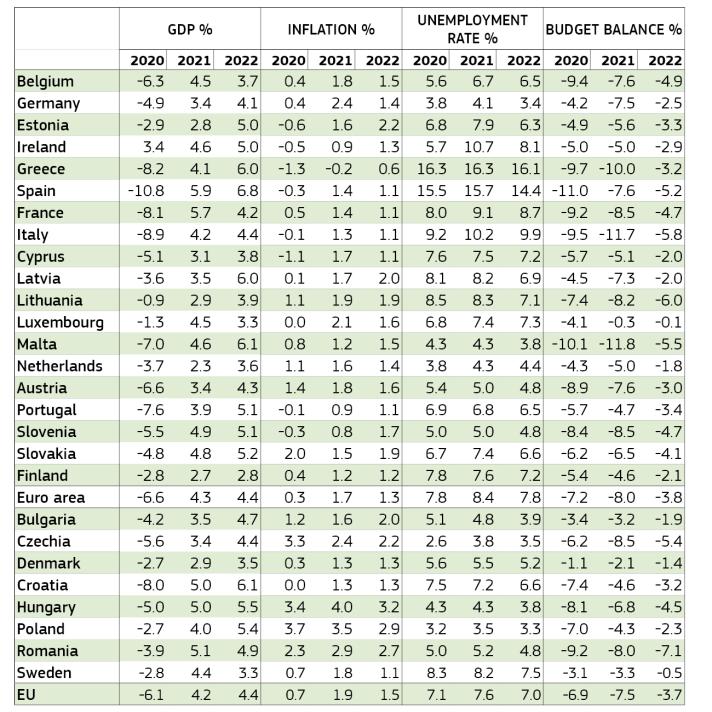

Table 1 : Overview - the spring 2021 forecast

…although a number of other key issues will also play an important role…

A number of other factors will also be critical to the outlook. These include the extent to which the EU can benefit from the improved external environment; the continuation of adequate policy support; the response of households and companies; and the extent to which the crisis leaves long‑term scars on the economy. An important question will concern whether the savings accumulated during past lockdown periods are unwound, and about the pace of decline of the savings rate, once restrictions ease. The fact that it is mostly high-income households that accumulated savings last year, as the Commission’s consumer surveys show, and that it is mostly the consumption of services that is constrained by the restrictions put in place in recent months, is likely to limit the potential for a large release of pent-up demand that would compensate for foregone spending.

…and the Recovery and Resilience Facility provides a unique opportunity for paving the way to a sustained recovery.

Policy will continue to play a key role. As the recovery takes hold, its focus will have to shift from damage control to strengthening the recovery and resilience of the EU economy. The implementation of the national Recovery and Resilience Plans under the Next Generation EU programme will serve this purpose. Following the final adoption of the Recovery and Resilience Facility (RRF) regulation in February this year and significant progress on the preparation of national Recovery and Resilience Plans (RRPs), the budgetary and economic impact of these plans has been incorporated into the forecast. The total EU expenditure expected to be financed by RRF grants over the forecast horizon amounts to EUR 140 billion, or just below 1% of 2019 GDP. The total economic impact generated by the RRF over the forecast horizon is expected to be approximately 1.2% of 2019 EU real GDP.

The recovery is already underway…

The latest Commission survey results suggest that activity in the EU economy has already moved up gear in recent months. As containment measures are gradually relaxed and the impact of the RRF kicks in, economic activity is set to accelerate in the third quarter, with countries, including those with large tourism sectors, benefitting from the return to quasi-normality of social activities over the summer. Growth is then forecast to remain solid in the last quarter of 2021, bringing EU GDP back to its pre‑crisis level earlier than previously projected.

…and is stronger than previously forecast.

All in all, the EU economy is forecast to grow by 4.2% in 2021 and to strengthen to around 4.4% in 2022 (4.3% and 4.4%, respectively, in the euro area). A stronger-than-previously expected rebound in global activity and trade, and the growth impulse provided by NGEU/RRF, help to explain the brighter outlook for all countries compared to the Winter Forecast. However, differences across countries in the pace of the recovery from the crisis remain substantial.

Private consumption will be in the driving seat...

As spending opportunities reopen and uncertainty about job and income prospects fade, private consumption will rebound and the household saving rate in the EU is expected to gradually decline from 19.4% in 2020 to 13.6% in 2022, still above its pre‑crisis level.

…together with a revival in investment…

The improving outlook for demand at home and from abroad, a continuation of favourable financing conditions, recovering profitability and increasing capacity utilisation rates are set to propel investment spending. At the same time, higher corporate distress induced by the crisis, lingering risk aversion and spare capacity in some sectors could hold back corporate investment. The NGEU/RRF is expected to finance both public and private investment projects, which will be rolled out with increasing intensity towards the end of the forecast horizon. The EU’s public investment-to-GDP ratio is forecast to rise to almost 3.5% in 2022, up from 3% in 2019, and back to its highest value since 2010.

… and a stronger external environment.

The global outlook has improved considerably, but the recovery is expected to be asynchronous and uneven across and within regions. Significantly improved prospects for the US economy reflect progress in vaccination and the two large fiscal packages adopted in late 2020/early 2021. This is expected to create positive spillovers for the global economy, including the EU. In China, growth is set to continue at a rapid pace, aided by buoyant global demand for goods. Elsewhere, many emerging economies are in a more challenging situation, with difficult access to vaccines and limited policy space weighing on growth prospects. All in all, global GDP (excl. the EU) is expected to grow by 5.9% in 2021 and by 4.2% in 2022, amid a solid expansion in global (excl. EU) trade. EU export markets are set to increase by 8.3% in 2021 and 6.4% in 2022, allowing EU merchandise exports to gain traction, while the recovery of service exports is set to take longer.

Inflation to peak in 2021 on transitory factors, before moderating in 2022.

Headline inflation increased sharply in early 2021 in both the EU and the euro area, reflecting rising energy prices and a host of temporary factors, including tax changes, base effects and the impact of a new weighting scheme of the inflation basket that better corresponds to the substantial changes to consumption patterns triggered by the pandemic. These factors will continue to shape the profile of inflation this year but should wear off gradually next year. The strong demand recovery and, to a lesser extent, high transport costs and other supply-side constraints also push inflation up over the forecast horizon. Remaining slack in the economy and the labour market is, however, expected to keep underlying inflationary pressures muted. HICP inflation in the EU is expected to increase from 0.7% in 2020 to 1.9% in 2021 and to moderate to 1.5% in 2022 (in the euro area, inflation would increase from 0.3% in 2020, to 1.7% in 2021 and 1.3% in 2022).

Labour market outlook reliant on continued policy support…

The widespread use of job retention schemes that kept many employees attached to their jobs helped contain the deterioration of labour markets in 2020, which was nonetheless substantial. After the initial hit from the pandemic, labour market conditions slowly started to improve in the second half of the year, with many people returning to the labour force and many workers exiting short-time work schemes. However, employment will take time to fully recover, as there is scope for working hours to increase before companies need to start hiring again. Further job losses and higher unemployment rates are expected in some Member States this year, but next year headcount employment is expected to start increasing and unemployment rates should decline across the EU. The EU unemployment rate is forecast to rise to 7.6% this year and to decline to around 7% in 2022, above the rate of 6.7% in 2019. The labour market outlook hinges not only on the speed of the economic recovery, but also on the timing of policy support withdrawal and the pace at which workers are reallocated across sectors and firms.

…amid a supportive policy mix…

Given the size of the emergency support measures put in place to cushion households and firms from the negative impact of the COVID-19 pandemic, the EU fiscal stance will continue to be supportive this year. In 2022, fiscal policy in the EU is expected to remain slightly supportive, also thanks to the support from the expected acceleration in spending financed by RRF grants. The long accommodative monetary policy environment complements and reinforces the fiscal stimulus as favourable financing conditions are set to support governments, corporates and households over the forecast horizon.

…with public deficit and debt set to increase further this year on the back of continuing support measures.

The aggregate general government deficit in the EU and the euro area increased significantly from around ½% of GDP in 2019 to around 7% of GDP last year, due to the impact from the operation of automatic stabilisers and sizeable discretionary fiscal measures. The deficit ratio in both areas is set to increase further this year, to about 7.5% and 8% of GDP respectively, following the extension of emergency policy support. In 2022, the deficits in the EU and the euro area are both expected to halve to around 3¾% of GDP, thanks to the continued economic recovery and the phasing out of much of the temporary policy support. The EU and euro area debt-to-GDP ratios are projected to rise further this year, reaching a new peak of around 95% and 102% in the EU and the euro area, respectively, before decreasing slightly in 2022.

Risks to outlook broadly balanced overall…

The risks surrounding the GDP forecast are high and will remain so as long as the pandemic hangs over the economy. On the epidemiological front, developments concerning the pandemic and the efficiency and effectiveness of vaccination programmes could turn out better or worse than assumed in the central scenario of this forecast. On the economic side, this forecast may underestimate the propensity of households to spend, or, on the opposite, consumers’ desire to maintain high levels of precautionary savings. The impact of alternative paths for the evolution of household savings is assessed in the model-based analysis presented in this publication. Another risk to the outlook is the timing of policy support withdrawal, which if premature could jeopardise the recovery. On the downside, the impact of corporate distress on the labour market and the financial sector could prove worse than anticipated. On the upside, stronger than projected global growth, particularly in the US, could have a more positive impact on the European economy than expected. Stronger US growth, however, risks pushing up US sovereign bond yields, which could interact with the materialisation of idiosyncratic risks (stemming from e.g. the slow vaccination rollout) in highly indebted emerging market economies with high foreign currency debts, causing disorderly adjustments in financial markets. Inflation in EU could turn out higher if the rebound in the European and global economies is stronger than expected, or if current supply constraints turn out more persistent. Overall, the risks surrounding the outlook are broadly balanced.

Forecast by country

| Candidate Countries | Other Non-EU Countries |

| Albania | UK |

| Montenegro | USA |

| North Macedonia | Japan |

| Serbia | China |

| Turkey | EFTA |

| Russia |

Documents

Thematic boxes

Thematic Special Topics

Media

Spring Economic Forecast 2021 infographic

EC press conference by Commissioner Paolo GENTILONI on the Spring 2021 Economic Forecast