One decision to be made is how the euro will be introduced: each EU country must choose among three possible scenarios the one which best meets its needs.

The Madrid scenario

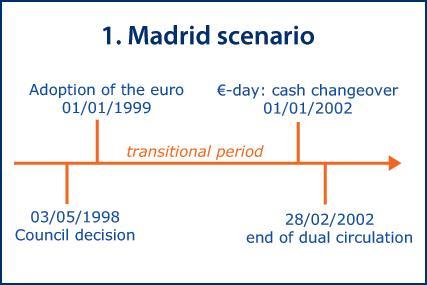

In the preparations for the introduction of the euro in 1999, Member States applied the ‘Madrid scenario’, so-called because it was agreed at the European Council meeting in Madrid in 1995.

The Madrid scenario set the legal framework and the timetable for the adoption of the euro, which involved a gradual changeover during a three-year transitional period:

- On 31 December 1998, the euro conversion rates for the national currencies of the Member States adopting the euro were irrevocably fixed.

- On 1 January 1999, the euro became the official currency of the participating countries. The national currency units became 'sub-units' of the euro, and national banknotes and coins remained in circulation. Consumers saw dual price displays in euro and the national currency units, e.g. in shops and on bank account statements, but euro cash was yet to be made available. Governments, financial institutions and companies began operating in euro, e.g. for wholesale transactions and for issuing debt. The euro was in widespread use as ‘book money’ and as a unit of account.

- Euro banknotes and coins were first introduced in the euro-area countries on 1 January 2002 (€-day), three years after the euro was launched. During a short period of dual circulation when both euro and national cash were legal tender, the latter was progressively withdrawn from circulation, mainly collected by shops and banks. The dual circulation period came to an end on 28 February – or even before in some countries – so that from 1 March 2002 only euro banknotes and coins were accepted for payment in the euro area.

The 'big bang' scenarios

Establishing the euro area involved launching a totally new currency. For Member States that will join the euro area later, the situation is different, as the euro already exists. This facilitates the changeover process as new entrants can rely on the support and experience of euro-area members. They can also choose to implement the changeover in different ways. Two alternative scenarios to the Madrid scenario have therefore been introduced in the EU legal framework:

- The big bang scenario: there is no transitional period. Euro banknotes and coins enter use on the same day as the euro officially becomes the country’s new currency. As in the Madrid scenario, national banknotes and coins can still be used for payments during a dual circulation period of up to six months.

- The big bang scenario with phasing-out: this variant of the big bang scenario allows for a phasing-out period of up to one year during which certain new legal instruments, such as contracts, may still refer to the national currency unit. This scenario preserves the advantages of the big bang approach – namely, a swift introduction of the euro – while allowing some leeway in phasing out the national currency, which can be useful for the conversion of complex systems, such as IT systems. However, it is only recommended as a fall-back solution should difficulties in the implementation of the normal big bang scenario emerge at a late stage in the proceedings.

The choice of which changeover scenario to adopt is taken by the future euro-area country, which will inform the EU institutions of their choice, and will also decide on the duration of any transitional or phasing-out periods, and the duration of dual circulation, within the limits set by the EU.