Staying the course amid high risks

Commission forecasts euro area growth of 1.6% and EU growth of 1.8% in 2016. Economic growth in Europe is expected to remain modest as key trading partners' performance has slowed and some of the so far supportive factors start to wane. As a result, GDP in the euro area is forecast to continue growing at modest rates over the 2015-2017 period.

The economies of all Member States should grow by 2017

While the trend of widely differing economic performance continues, EU GDP is now higher than before the crisis and GDP in some Member States stands more than 10% above its trough. Over the forecast period, economic activity in all Member States is set to increase further but to remain uneven.

Labour market improvement to continue

The moderate pace of improvement in labour markets is expected to continue, driven by the lagged response to improved cyclical conditions and contained wage growth. In some Member States, labour market reforms implemented in recent years and fiscal policy measures are also supporting net job creation. Although labour market disparities are set to remain for some time, unemployment in the euro area is expected to fall to 10.3% in 2016 and then 9.9% in 2017, compared to 10.9% in 2015. In the EU as a whole, unemployment is expected to fall from 9.4% in 2015 to 8.9% in 2016 and 8.5% in 2017.

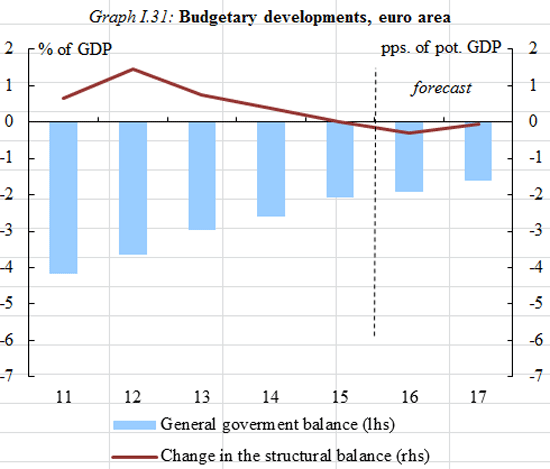

Fiscal policy remains supportive; the fiscal outlook improves

The aggregate general government deficit in both the euro area and the EU is forecast to continue decreasing this year and next, on the back of economic growth and low interest rates. The general government deficit in the euro area as a whole is expected to decrease from 2.1% of GDP in 2015 (EU 2.4%) to 1.9% in 2016 (EU 2.1%) and 1.6% in 2017 (EU 1.8%), under a no-policy-change assumption. The fiscal stance of the euro area is expected to be slightly expansionary this year. The debt-to-GDP ratio meanwhile is forecast to continue declining gradually from 94.4% in 2014 to 91.1% in the euro area in 2017 (EU 85.5%).

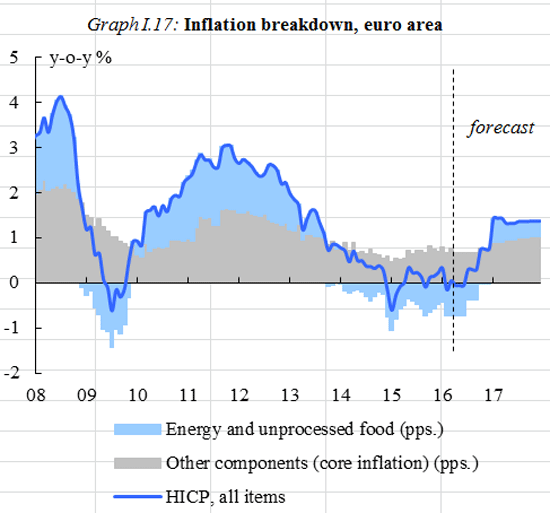

Inflation remains driven by energy prices

Oil prices fell again at the start of 2016, dragging inflation below zero. It is expected that inflation remains close to zero in the near term as energy prices are lower than a year ago. External price pressures are also weak amid a slightly appreciating euro and rather subdued global producer prices. Inflation should rise more significantly in the second half of this year as energy prices gradually pick up and domestic prices increase on the back of strengthening domestic demand. Consumer price inflation is forecast at 0.2% in the euro area this year (EU 0.3%) and at 1.4% in 2017 (EU 1.5%).

The outlook for global growth remains weak

Growth outside the EU last year likely fell to its slowest pace since 2009 (at 3.2% in 2015), triggered by the slowdown in emerging markets. The outlook for global GDP growth has weakened further as major advanced economies also slowed, and expectations of a modest pick-up are subject to a high degree of uncertainty. The world economy is expected to grow by 3.1% in 2016 and 3.4% in 2017.

Considerable risks surround the European economic outlook

Substantial uncertainty surrounds this forecast. External risks include the possibility that slower growth in emerging markets, particularly China, could trigger stronger spillovers or turn out worse than expected. Uncertainty linked to geopolitical tensions remains high and could affect European economies more negatively than currently expected. Abrupt moves in oil prices or financial market turmoil could also dampen European growth. Additionally, risks associated with domestic EU developments remain considerable, as for instance with regards to the pace of implementation of structural reforms and the uncertainty ahead of the UK’s EU referendum. Conversely, the positive impact from structural reforms could turn out greater than estimated and the transmission of very accommodative monetary policies to the real economy could prove to be stronger than expected.

Background information

This forecast takes into consideration all relevant available data and factors, including assumptions about government policies, up until and including 22 April 2016. Only policies credibly announced and specified in adequate detail are incorporated. Projections assume no policy changes. This forecast is also based on a set of external assumptions concerning exchange rates, interest rates and commodity prices. The numbers used reflect market expectations derived from derivatives markets at the time of the forecast.

This economic forecast will feed into the Spring package of the European Semester.

The Commission is due to update its economic forecast in November 2016.

Documents

Thematic boxes

Media

- Spring Economic Forecast 2016 infographic

- EC press conference Commissioner Pierre MOSCOVICI on Spring Economic Forecast 2016

- Press conference Q & A

- Forecast presentation

- Press release IP/16/1613 of 3 May 2016

Related documents

- Data source: Annual macroeconomic database (AMECO)